when will capital gains tax increase take effect

These taxpayers would have to pay a tax rate of 396 on long-term capital gains. In this case it might be.

As it grew clear that higher capital gains taxes were coming the SP 500 languished and went sideways.

. Capital gains tax rates on most assets held for a year or less correspond to. The short answer is that the earliest President-elect Bidens tax changes including increases in the federal income tax rates could happen would. Apr 23 2021 217 PM EDT.

When the Treasury introduced changes to the Entrepreneurs Relief now Business Asset Disposal Relief in the spring 2020 Budget the government outlined the proposed changes to the legislation some of which were effective from the Budget date 11 March 2020. In 2021 the estate and gift tax exemption of 117 million 234 million for married couples will still allow your clients to pass on up to that amount before paying any estate tax but any assets rising above that threshold are at risk of double taxation estate tax and capital gains tax without the step-up exemption. Weve got all the 2021 and 2022 capital gains tax rates in one place.

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the. Under the current-law regime where investors have numerous avenues to avoid capital gains taxes we estimate that raising the top statutory rate on capital gains to 396 percent would decrease revenue by 33 billion over fiscal years 2022-2031.

President Joe Biden has been expected to introduce a higher capital gains tax rate totaling 434 for the wealthiest taxpayers earning 1 million or more strategists said. Should Bidens new capital gains provisions take effect in 2022 your total tax would be increased by over 300000. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket.

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. The Chancellor will announce the next Budget on 3 March 2021. The White House is considering raising the capital gains tax rate to 396 on people earning 1 million and over people familiar with the matter told Bloomberg on Monday.

Revenue effects of the proposal depend on how unrealized capital gains are treated at death. Raising the top marginal tax rate on individual income to 396 percent and applying an 8 percent surtax on MAGI above 25 million would bring the combined top marginal tax rate on individual income to 573 percent up from 429 percent under current law and above the OECD average of 426 percent. Thus for households earning more than 1 million the capital gains tax rate would increase from 238 to 434 as of April 28 2021 thus eliminating the opportunity to recognize gain at current rates in advance of the legislation.

Keep in mind however that the President still needs Congress to agree to this retroactivity and Democrats have a. Joe Biden reportedly is going to propose raising the capital gains tax rate to 434 for wealthy individuals from 238. Hed like to raise the top rate on income taxes to 396 from 37.

This tax increase applies to high-income individuals with an AGI of more than 1 million. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. A capital gain is when you sell an investment or an asset for a profit.

President Bidens coming proposal to increase capital gains taxes for the richest Americans could push the rate paid by investors when they sell stocks and other assets as high as 567 in some. Biden is set to propose a sharp increase in capital gains tax to 396 from the current 20 level for those making more than 1 million a year. The changes will be effective from the new tax year starting 6 April 2021.

It has sent Wall Street into a tizzy. The way the market handled the last major CGT increase at the end of 2012 is instructive. When you realize a.

The top tax rate on long-term capital gains -- that is returns on the sale of stocks or other investments -- would increase to 396 from 20.

Capital Gains Tax What Is It When Do You Pay It

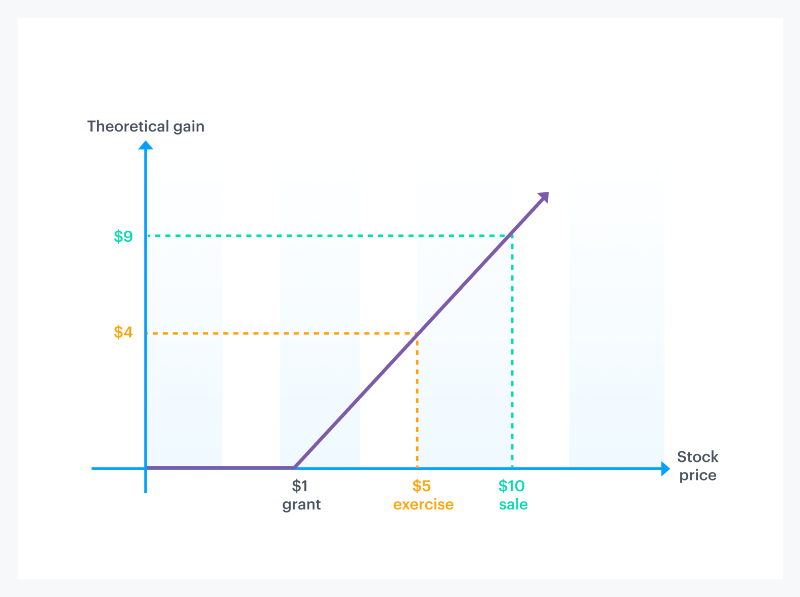

How Stock Options Are Taxed Carta

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax In Canada Explained

How To Calculate Capital Gains Tax H R Block

Trust Tax Rates And Exemptions For 2022 Smartasset

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Money Isn T Everything Capital Gain

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Understanding Capital Gains Tax In Planning Your Estate Trust Will

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

How To Calculate Capital Gains Tax H R Block

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)